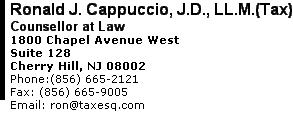

As a Tax Attorney experience in

governmental tax liens and tax sale certificates, Ronald J.

Cappuccio, J.D., LL.M. (Tax) can

help:

Understanding

Tax Lien Certificates and Tax Sale Deeds

Tax Lien Certificates are rights to collect money

paid for taxes and usually interest. It does not entitle the holder

to possession of the property with foreclosure proceedings after a 2

or 3 year wait. A tax Sale Deed is just that...a deed to the

property.

What is

the Tax Lien Certificate foreclosure

process?

In order to obtain ownership in the

property, a tax lien certificate holder must start a special lawsuit

known as a "foreclosure."

Legal

Questions

Here are some

Commonly asked legal questions concerning tax sale certificates and

liens.

Links to Official Tax Sale

Sites

Here are Links that are

useful in finding out about Tax Lien Certificates and Deeds in

various States and Localities.

Tax

Law Questions

The

TaxEsq.Com site with hundreds of pages of information!

|